Historical Performance of the Pi Coin

Pi Network is a crypto project designed to create a decentralized digital asset. Founded by Stanford graduates Nicolas Kokkalis and Chengdiao Fan, it introduces a unique mining approach that leverages users’ daily mobile interactions. The goal is to simplify crypto participation, making it accessible to a wider audience. Unlike Bitcoin, which relies on energy-intensive mining, Pi Network is still in its early stages, undergoing testing and development.

By redefining crypto mining, Pi Network introduces a novel consensus mechanism called “Proof-of-Mining,” allowing users to earn Pi coins directly from their smartphones. Its focus on accessibility and inclusion sets it apart, ensuring that anyone with a mobile device can participate in the network.

A key milestone in Pi Network’s journey is the transition to Open Network on February 20, 2025. This shift will enable Pi to connect with external blockchains, be traded on exchanges, and expand its real-world applications. By removing restrictions, the Open Network will determine how Pi integrates into the broader crypto ecosystem.

Factors Influencing the Pi Coin Price

Let’s examine the different factors that impact the price of a Pi Coin:

Market Dynamics

Market sentiment plays a crucial role in shaping the crypto landscape. Positive developments, such as favorable news or key milestones, can boost confidence and drive Pi Coin’s price upward. Additionally, Bitcoin’s performance has a ripple effect on altcoins like Pi Coin and the broader market. When investors are optimistic about Bitcoin’s future or its mainstream adoption, it creates a supportive environment for other crypto assets to thrive. As a result, Pi Coin’s growth is often linked to the overall sentiment surrounding Bitcoin and the crypto industry.

Technological Advancements

Technological advancements within Pi Network’s ecosystem can significantly influence the value of Pi Coin. If Pi introduces innovative features or improvements that offer distinct advantages over existing crypto assets, it could attract investor interest and shift market attention toward Pi Coin. This increased adoption and confidence may, in turn, impact its market dynamics and overall valuation.

Regulatory Environment

Governments tend to approach crypto assets like Pi Coin with caution. As Pi moves toward wider adoption, regulatory scrutiny is likely to intensify. Authorities often view decentralized and unregulated assets warily, as they operate beyond traditional financial controls. Many governments remain hesitant to support currencies outside their jurisdiction, which could lead to the introduction of regulations aimed at exerting oversight. Such measures may influence the decentralization of digital assets like Pi Coin, potentially affecting its market value and adoption.

- Supply and Demand Dynamics:

The controlled release of new Pi Coins—through decreasing mining rates and potential token burns or lock-ups—plays a crucial role in its scarcity and, by extension, its price. If demand outstrips the available supply, the price may rise, and vice versa. - Adoption and Utility:

Pi’s long-term value is closely tied to how widely it’s adopted for real-world transactions, decentralized applications, and partnerships. The more the ecosystem expands and the coin is used in everyday commerce, the more attractive it becomes to investors. - Exchange Listings and Liquidity:

Listing on major cryptocurrency exchanges can dramatically increase liquidity and provide a transparent market for price discovery. Without such listings, trading remains limited and the coin’s value largely speculative. - Regulatory Environment:

Compliance with KYC, AML regulations, and broader governmental policies can either boost investor confidence or, conversely, create hurdles that limit market access and adoption. Regulatory clarity is essential for fostering trust and long-term growth. - Market Sentiment and Speculation:

Like most cryptocurrencies, Pi’s price is subject to the broader moods of the market. Hype generated by community enthusiasm, media coverage, or influencer endorsements can lead to short-term price swings, while bearish sentiment or uncertainty might drive the price down. - Technical Developments and Network Milestones:

Key milestones—such as the transition from a closed to an open mainnet, upgrades in the underlying technology, or enhanced security measures—can have a significant impact on investor perception and the coin’s long-term viability.

Historical Performance of the Pi Coin

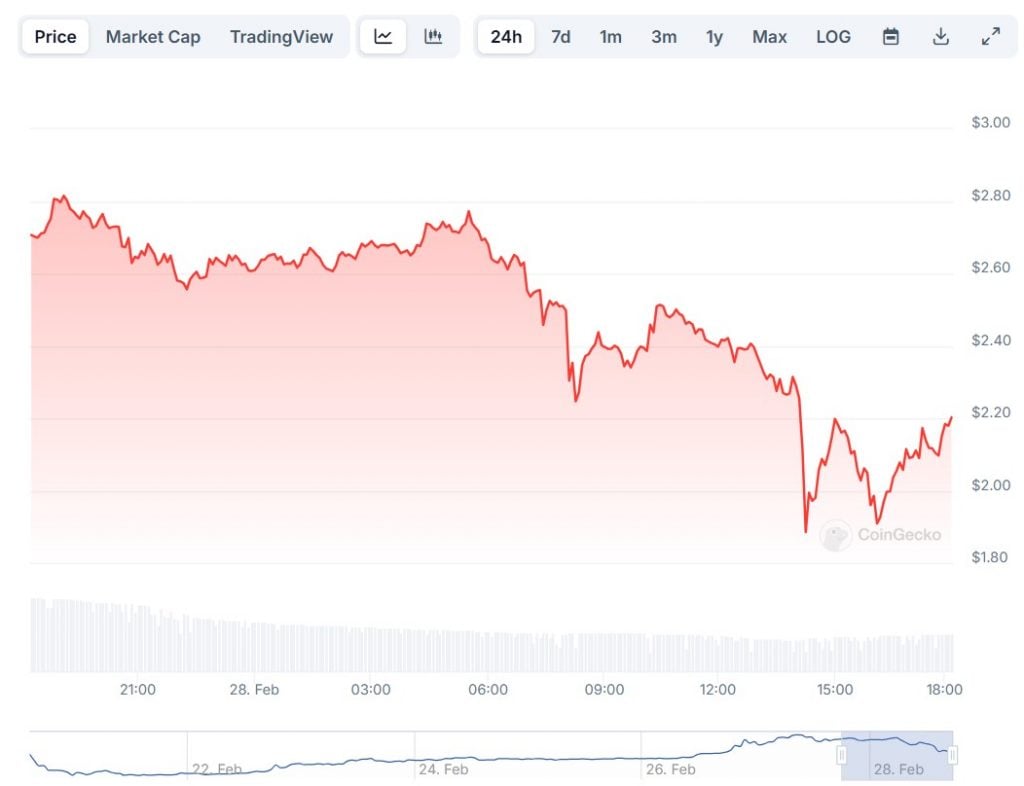

Crypto.com records indicate that Pi Coin’s price history began in December 2022. Over the past year, its value has seen notable fluctuations. Between March and April 2024, Pi Coin traded in the $100-$125 range before dropping below $50 from May to October 2024. Signs of recovery emerged in November 2024, with prices moving between $50-$75, followed by a climb to $75-$100 in December 2024.

Entering 2025, Pi Coin once again dipped below $50 during January and February, briefly rebounded past $75, and then declined again.

Pi Network’s (PI) Long-Term Price Prediction from 2025 to 2030

With Pi Network transitioning to an Open Network, its price dynamics could see significant changes. Since the update introduces external connectivity and potential exchange listings, making an accurate long-term prediction is challenging. Market trends, adoption rates, and regulatory developments will all play a role in shaping Pi’s future value. However, users should stay informed and regularly monitor Pi’s price movements as the ecosystem evolves.

At the time of writing, Pi Network was priced at $2.26, with a 24-hour trading volume of $1,763,197,435.

Should I Invest in Pi Network (PI) in 2025?

Investing in Pi Network (PI) in 2025 comes with both potential upsides and significant uncertainties. Here are some key points to consider:

- Early Stage & Liquidity:

PI is still transitioning from an enclosed mainnet to open-market trading. This means its true market value isn’t yet proven, and liquidity could be limited until major exchanges list it.

m.economictimes.com - Risk vs. Reward:

While some analysts are optimistic—suggesting that a major exchange listing (for example, on Binance) could trigger a surge in price—others warn that until PI shows real-world utility and achieves widespread adoption, it remains a highly speculative investment.

bravenewcoin.com - Regulatory & Adoption Uncertainties:

The coin’s future is also tied to regulatory developments and its ability to build a robust ecosystem. Without these, even strong community support might not be enough to sustain long-term value. - Personal Investment Strategy:

If you have a high risk tolerance and are prepared for volatility, you might consider allocating only a small portion of your portfolio to PI. However, if you prefer more established assets with proven track records, you might want to be cautious.

In short, while Pi Network has an innovative approach and a large community, its investment potential in 2025 is still unproven and carries considerable risk. It’s essential to do your own research, consider your risk tolerance, and possibly consult with a financial advisor before deciding to invest

Pi Coin offers several advantages, but its original mining model has faced scrutiny, especially with the growing adoption of proof-of-stake mechanisms. However, progress continues with the Open Network transition, which could positively impact Pi Coin’s value by enabling external connectivity and exchange listings.

it’s essential to conduct thorough research and assess risk tolerance before making financial decisions. This blog does not constitute investment advice. Investors should always perform their own due diligence before investing in any crypto-related asset.

Conclusion

Pi Network has introduced an innovative approach to crypto mining, emphasizing accessibility and decentralization. With the Open Network transition, Pi Coin’s role in the broader crypto landscape could evolve significantly. However, its long-term success will depend on adoption, regulatory developments, and market dynamics. As with any crypto investment, investors should stay informed, monitor updates, and conduct thorough research before making any financial decisions.